Revenue /

Revenue / Cost Accruals

Revenue / Cost Accruals is a way of distributing the revenue / cost accruals into periods where the revenue / cost should have been taken.

💡 Pro Tips 💡

Lease Rent Example Assume you pay an annual lease of 40,000/- in January and would like to account for it as an expense each quarter to help with proper costing of overheads, then this module will apportion the amount into 4 equal parts as if payable at the beginning of each quarter.

- 2015-01-01 By Property Owner Cr. 10000

- 2015-01-01 To Lease Expenses A/c Dr. 10000

- 2015-02-16 To Property Owner Dr. 40000

- 2015-02-16 By Bank Chq A/c Cr. 40000

- 2015-04-01 By Property Owner Cr. 10000

- 2015-04-01 To Lease Expenses A/c Dr. 10000

- 2015-07-01 By Property Owner Cr. 10000

- 2015-07-01 To Lease Expenses A/c Dr. 10000

- 2016-10-01 By Property Owner Cr. 10000

- 2016-10-01 To Lease Expenses A/c Dr. 10000.

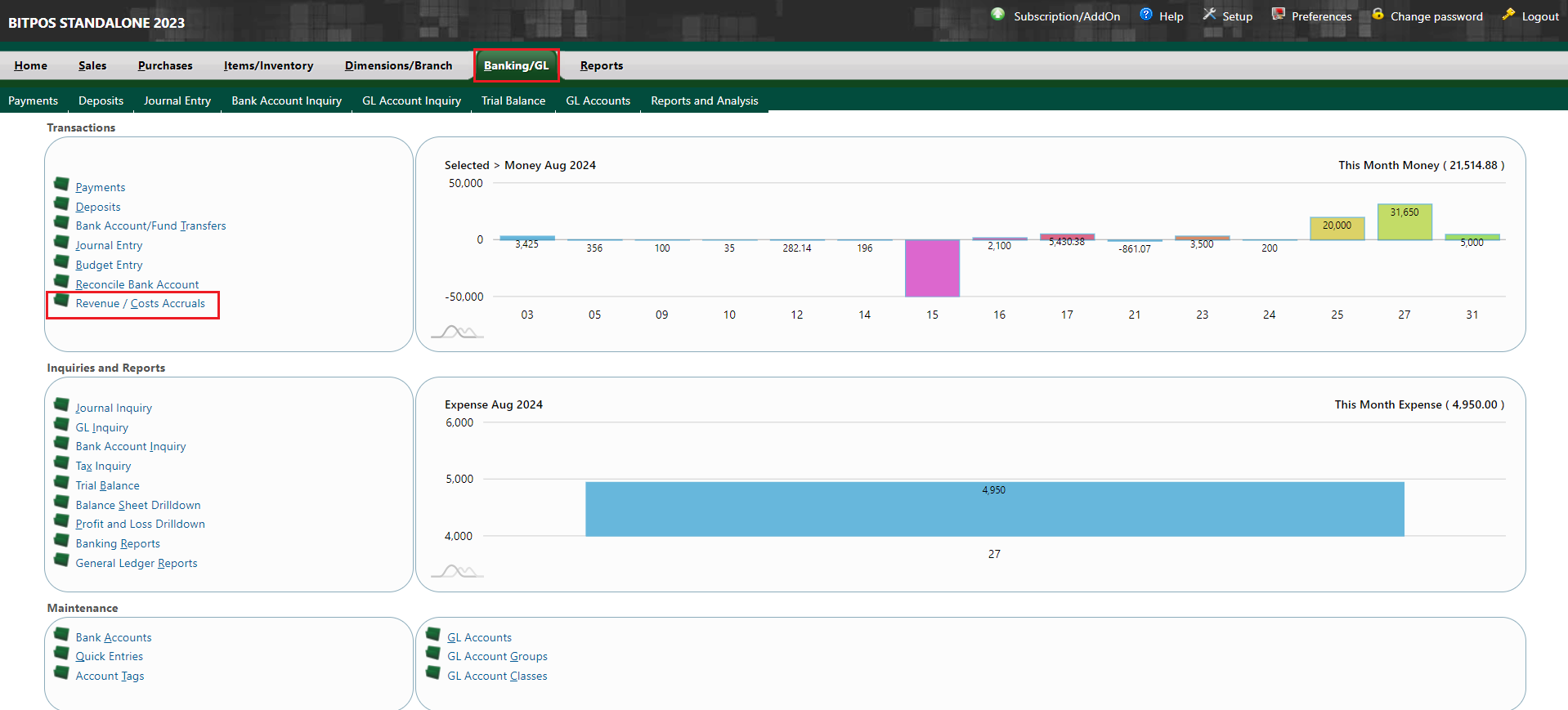

Step 1: Go to Banking/GL

- Select Revenue / Cost Accruals

|

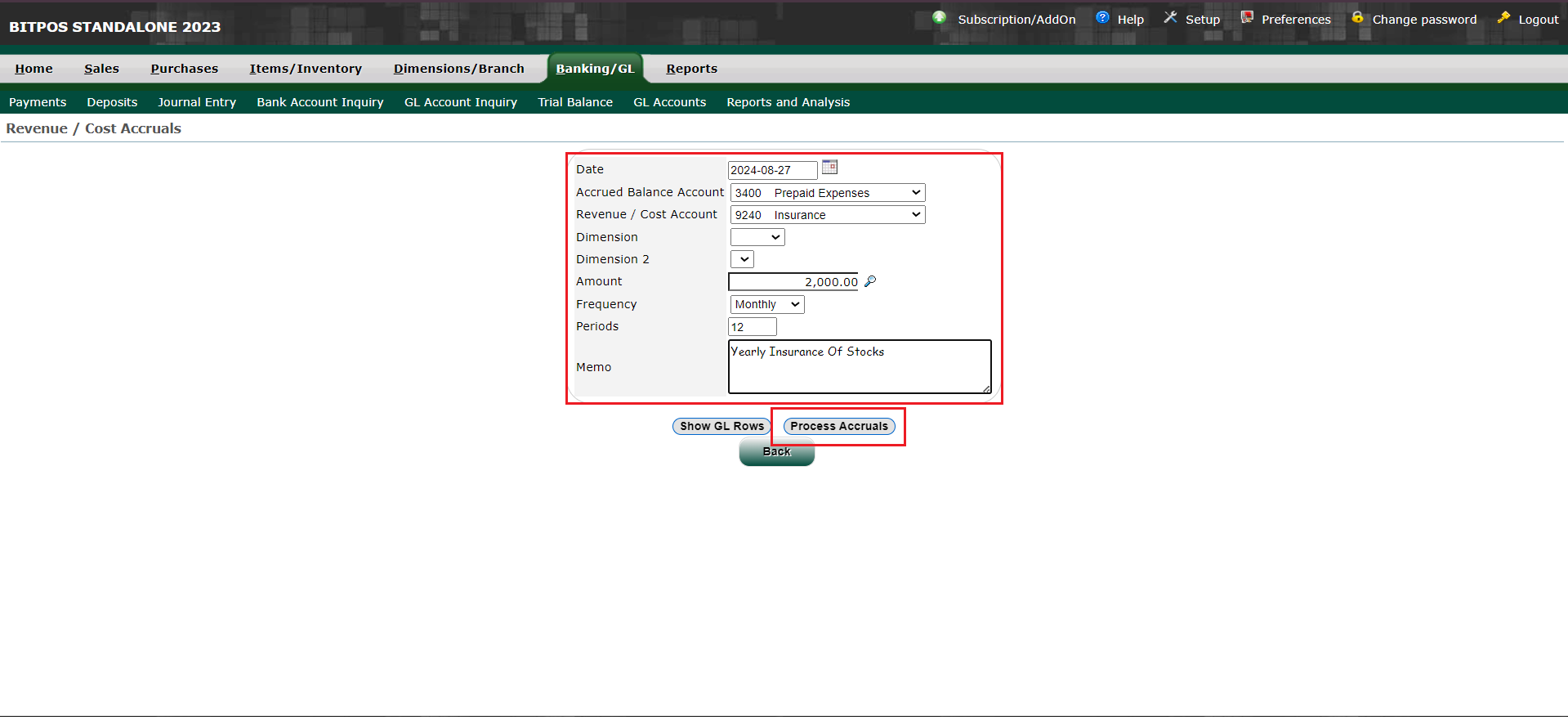

Scenario: You pay a yearly Insurance for your stocks for 2000. This is paid in January.

- Credit Bank Account 2000

- Debit would be an accrued balance account in the assets section.

- Not the normal expense account for insurance.

- Now you decide to Accrual this expense from your accrued balance account into the expense account for insurance during 12 periods of 1 month.

This is what this module handles, but with more selectable frequencies!

|