Taxes

Taxes is typically refers to whether a transaction is subject to Value Added Tax (VAT) or not. VAT is a consumption tax levied on the value added to goods and services at each stage of production or distribution. Non-VAT transactions are those exempt from VAT or not subject to it, such as certain types of goods or services.

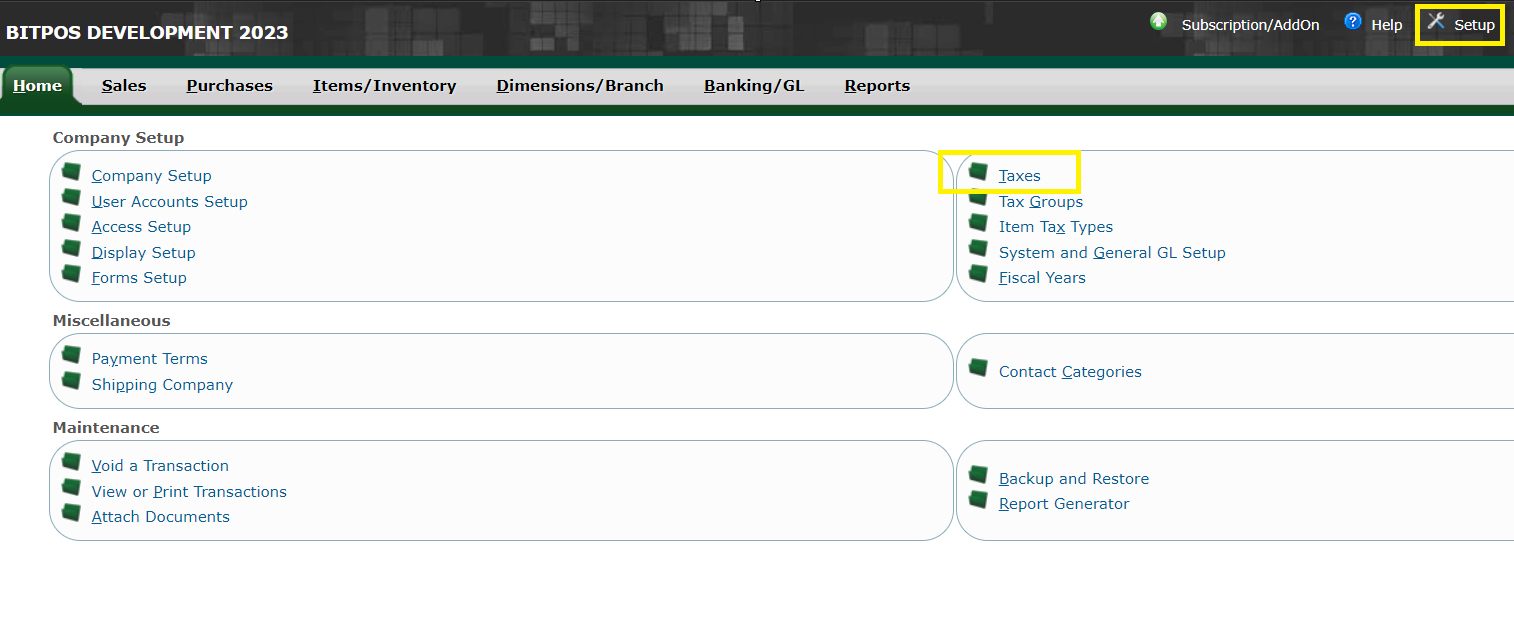

STEP 1: Accessing Back Office: You go into the Back Office and login. STEP 2: Go to Setup and locate the Taxes.

|

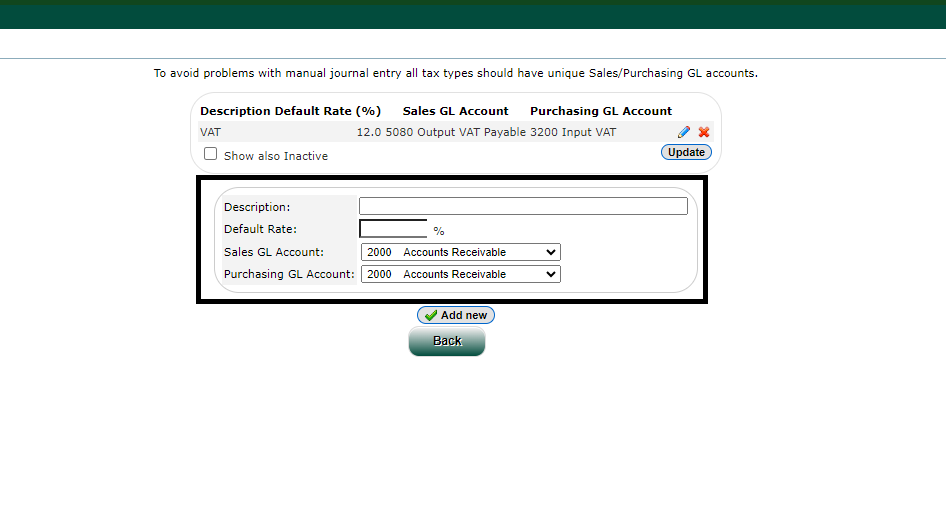

STEP 3:

• Type the Description which means brief name or purpose of tax type whether (VAT or NON-VAT).

• Type the Default Rate which means refers to the default tax rate applicable to transactions associated with this tax type. For example, if the tax type is VAT, the default rate might be 20%, indicating that VAT will be applied at a rate of 20% to eligible sales or purchases.

• Select the Sales GL Account which means record sales transactions.

• Select the Purchasing GL Account which means records purchasing transactions.

|

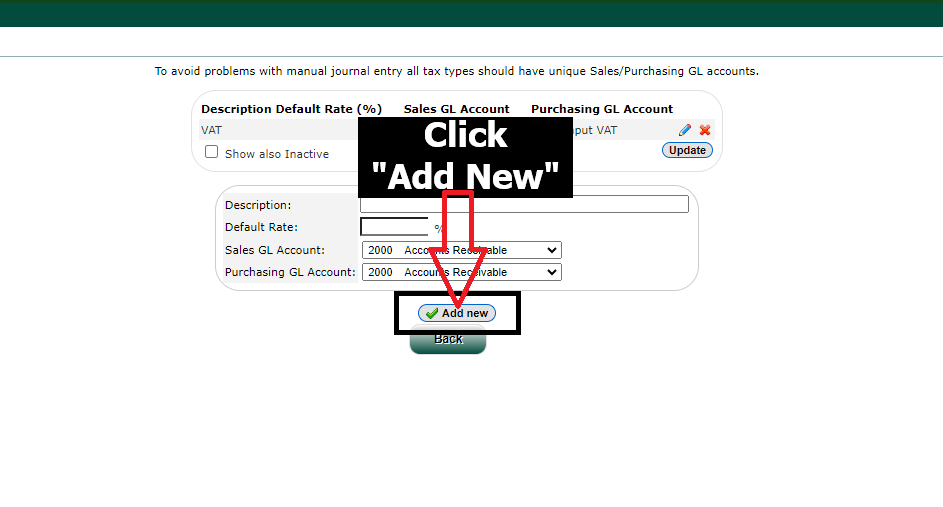

STEP 4: Click the Add New.

|

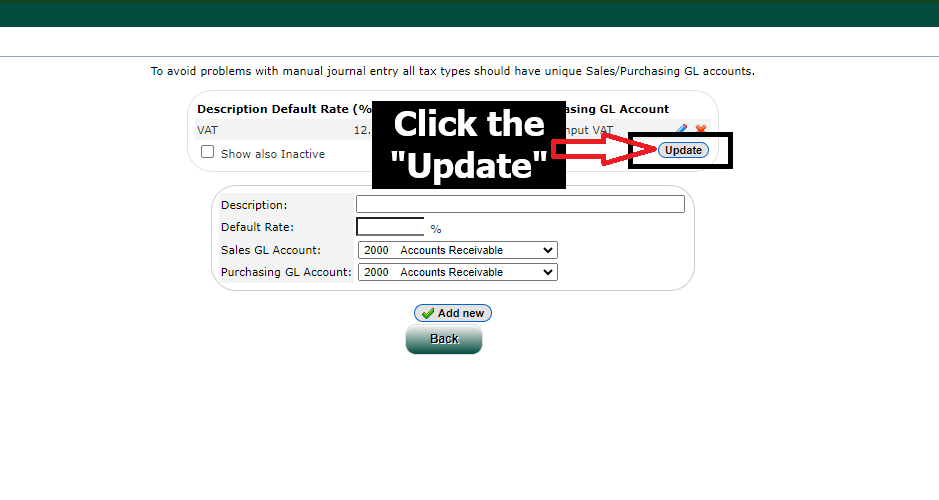

STEP 5: Click the Update button after you've added or made any changes.

|