Tax Groups

Tax Group is refers to a classification of entities or transactions for tax purposes. It helps businesses manage tax reporting, compliance, and analysis efficiently.

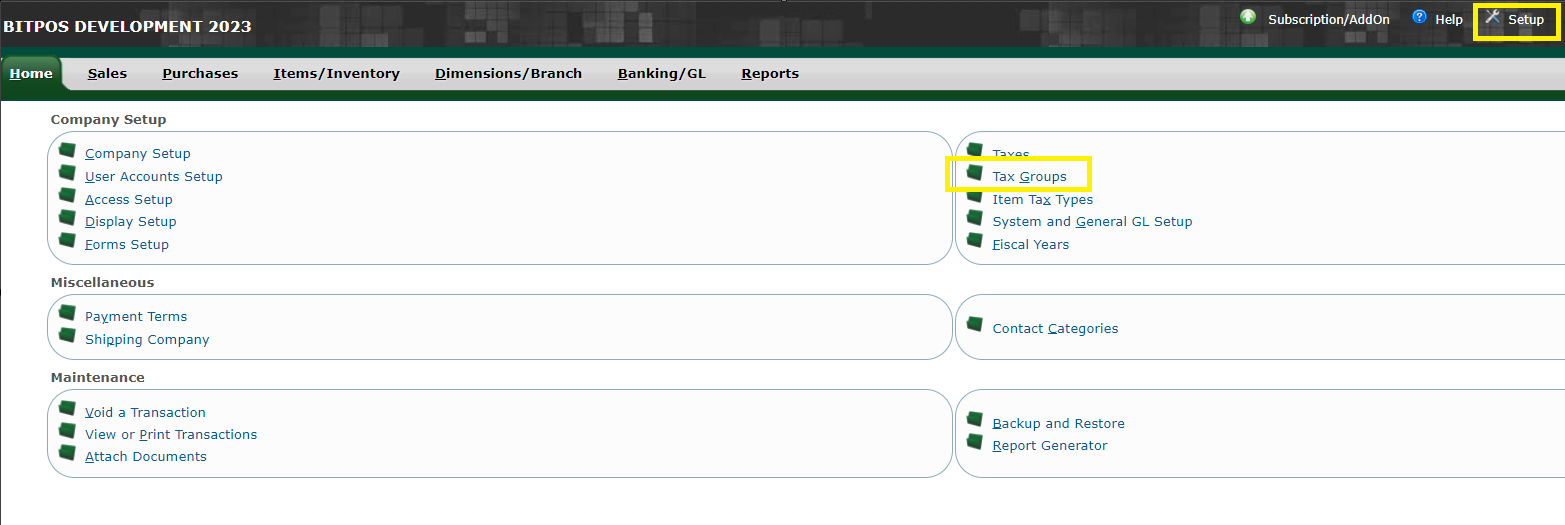

STEP 1: Accessing Back Office: You go into the Back Office and login. STEP 2: Go to Setup and locate the Tax Groups.

|

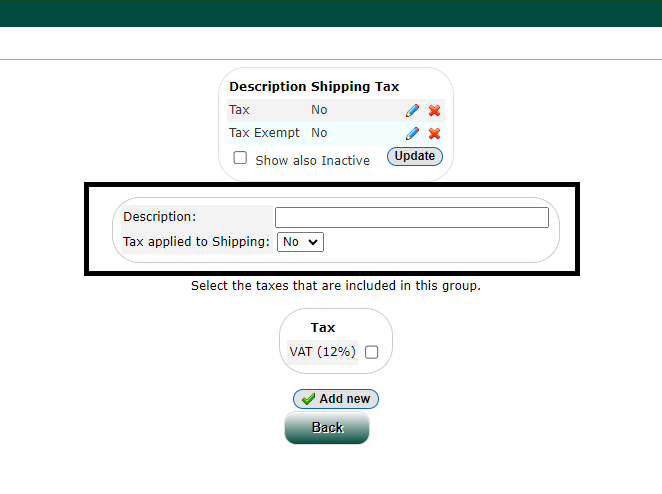

STEP 3:

• Type the Description which means refers to categorizing entities or transactions as taxable or tax-exempt. For example, goods or services subject to Value-Added Tax (VAT) would fall under Tax, while those exempt from VAT would be classified as Tax Exempt.

• Type the Tax Applied to Shipping which means indicates whether taxes are applied to shipping charges associated with transactions.

|

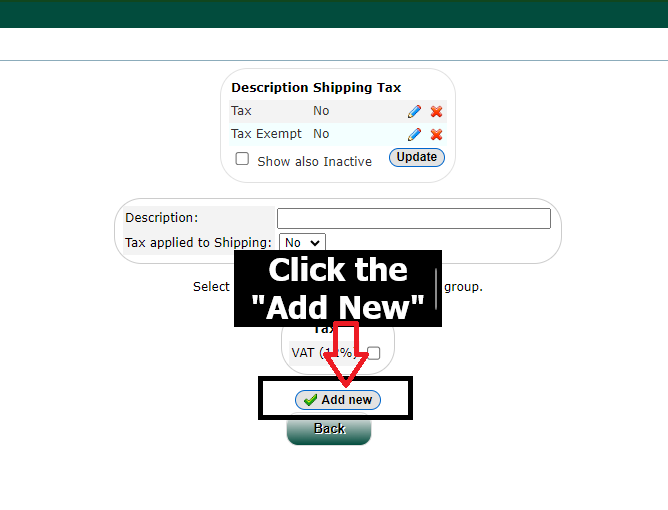

| STEP 4: Click the Add New. |

|

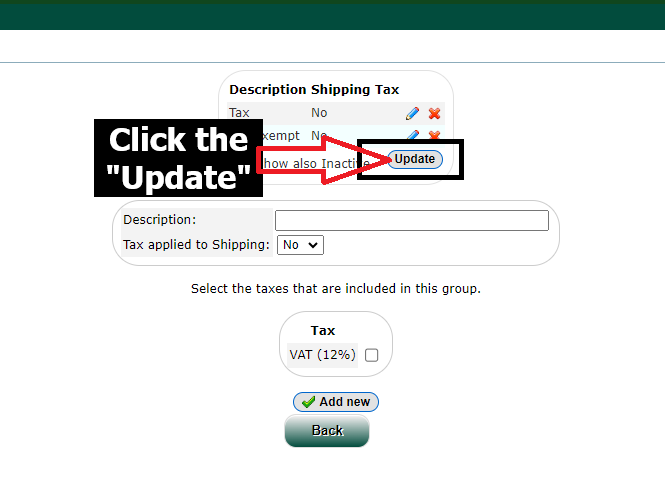

STEP 5: Click the Update button after you've added or made any changes.

|