PAYROLL SET UP

Our payroll system feature offers a robust and user-friendly solution designed to automate and streamline the payroll process for businesses. It calculates employee salaries with precision, incorporating factors like attendance, overtime, and statutory deductions (e.g., SSS, PhilHealth, Pag-IBIG) while ensuring compliance with the latest labor laws and tax regulations. The system also includes automated 13th month pay computation, customizable pay periods, and seamless integration with leave and attendance records. Additionally, it manages loan and cash advance deductions, providing accurate and timely payslip generation for easy distribution to employees.

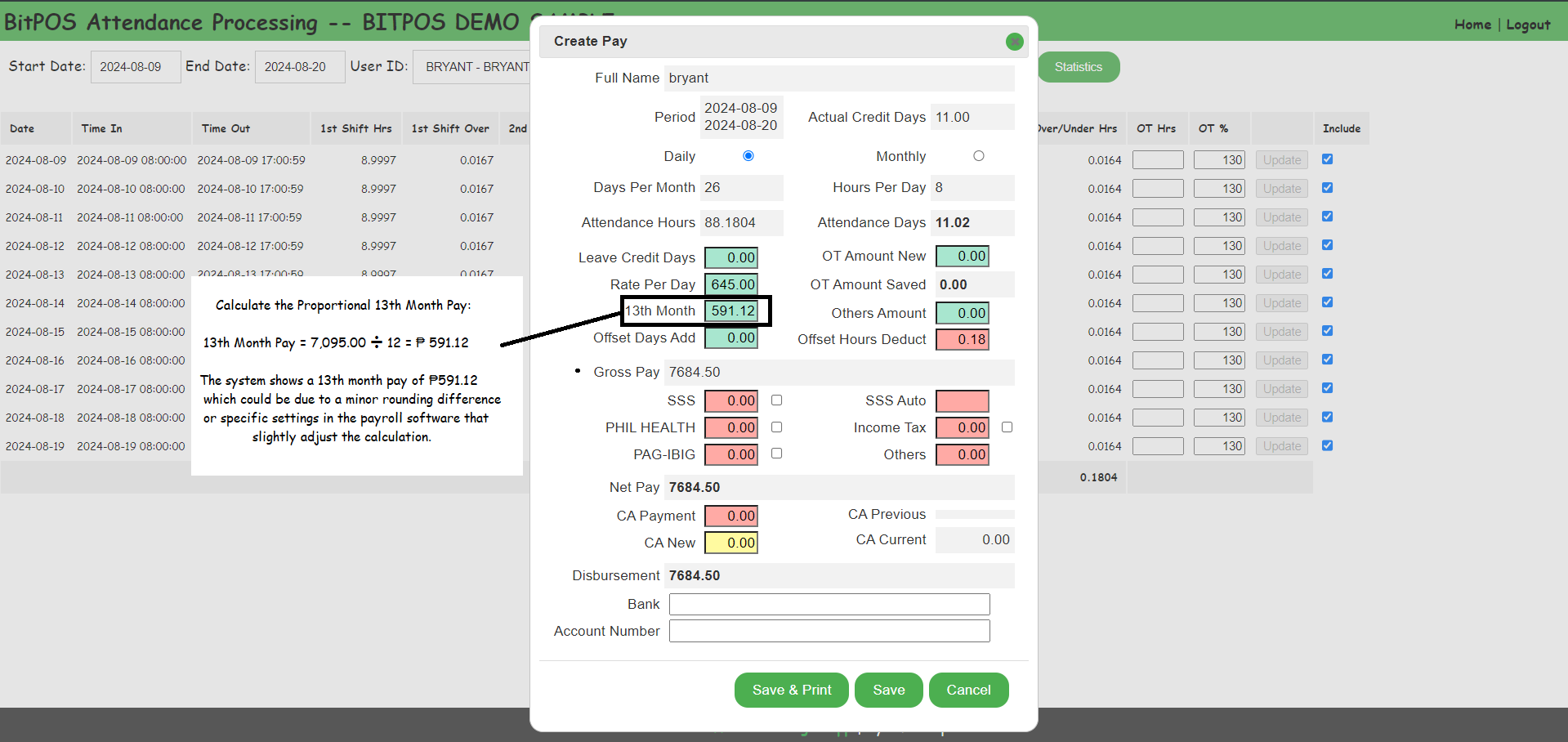

NOTE: Green boxes indicate additions to the pay, while red boxes indicate deductions.

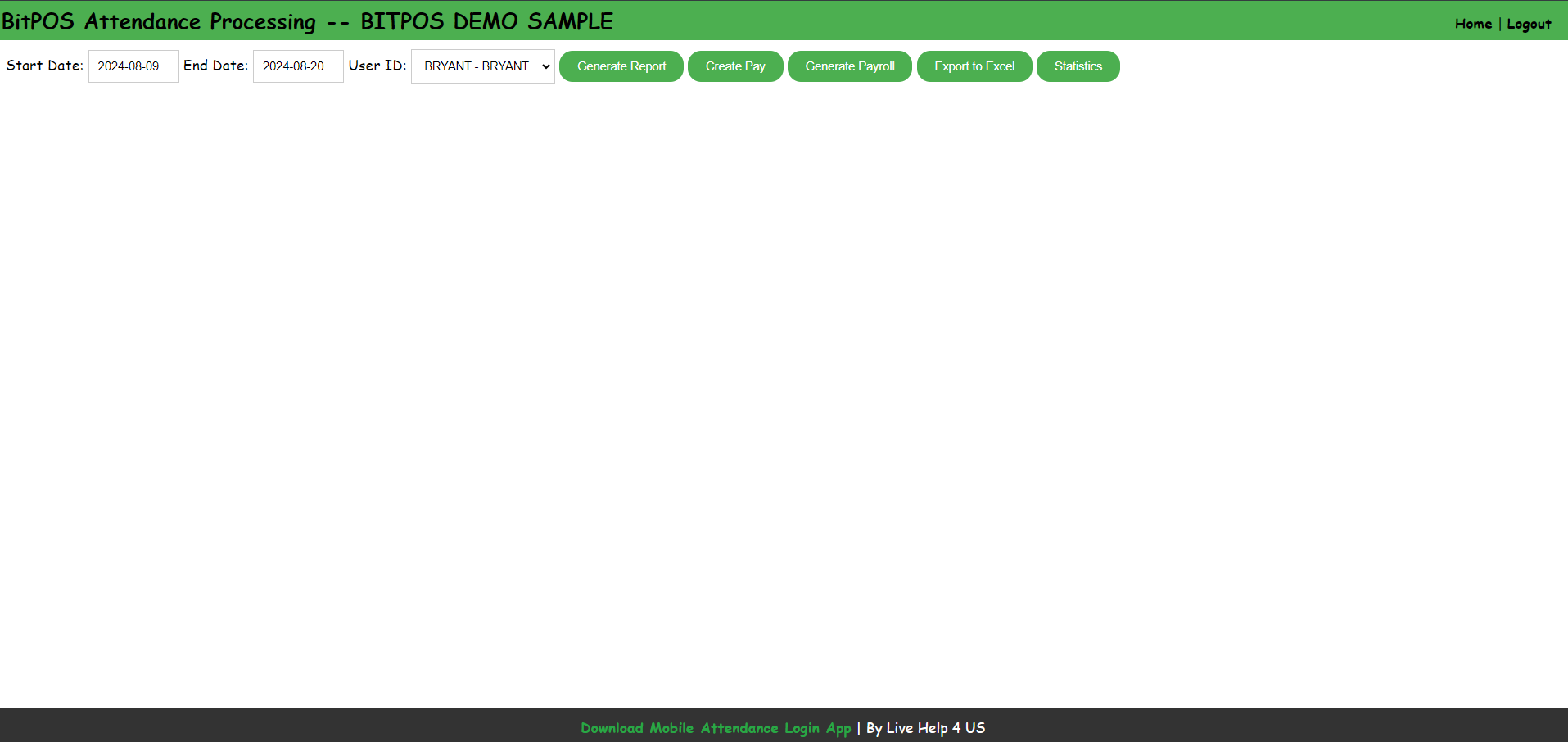

Step 1: Log in to your Cloud Link for attendance

Step 2:Filter the Following

- Start Date : Cut off (Example: August 09 - 20, 2024)

- User ID: Name of the Employee (Example: BRYANT-BRYANT

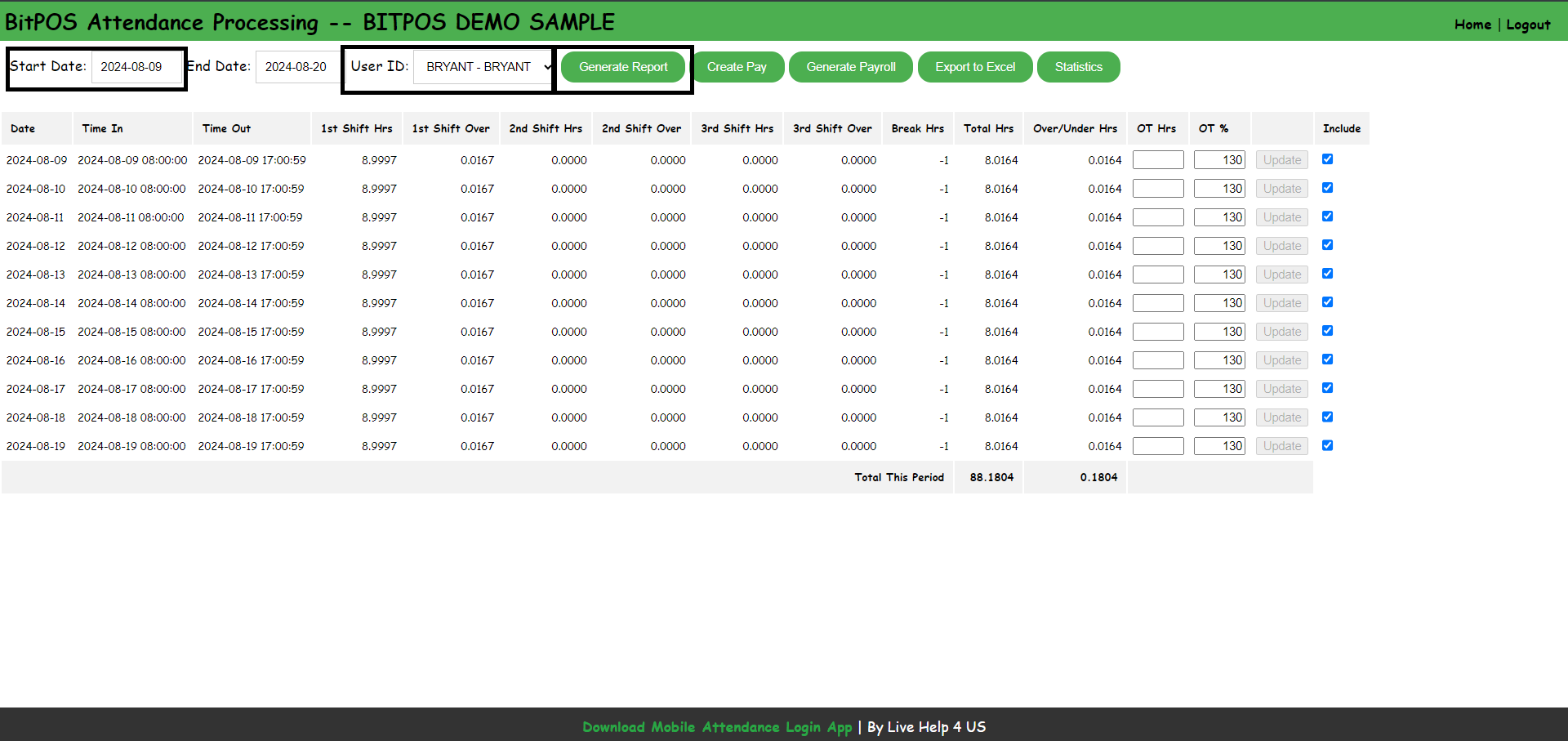

- Click Generate Report

Step 3:Once you generate the report you may able to see the Time In and Time Out of the system

- Next, you may able to Generate actual Payroll by clicking Create Pay

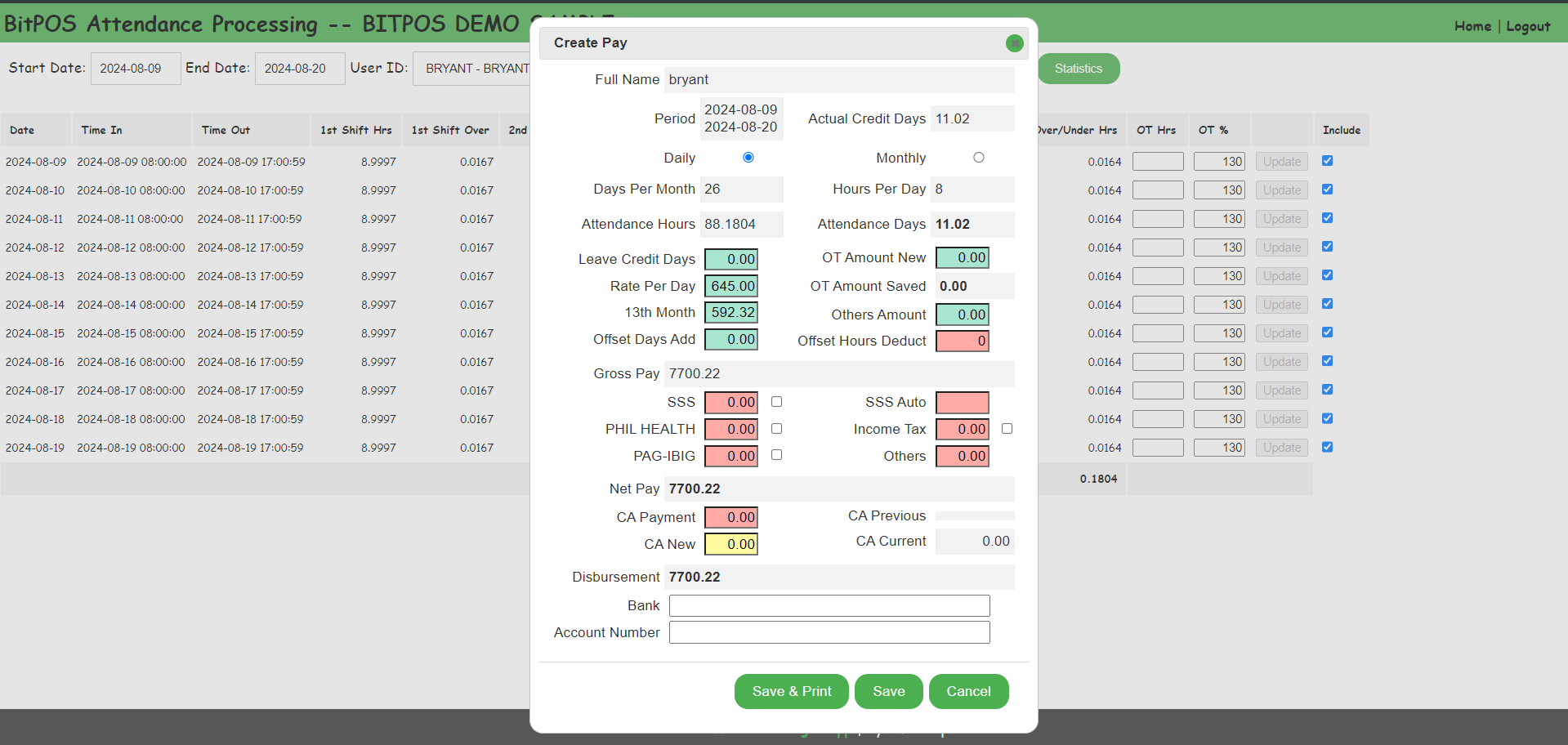

Please follow this guided Step By Step Process Computation

- A.) Actual Credit Days: the total number of days an employee is counted as having worked during a pay period.

- B.) Attendance Hours: the total hours an employee worked during a pay period.

- C.) Leave Credit Days: the days an employee is entitled to be paid while on leave, based on their accumulated leave credits.

- D.) Rate Per Day: the amount of money an employee is paid for each day they work.

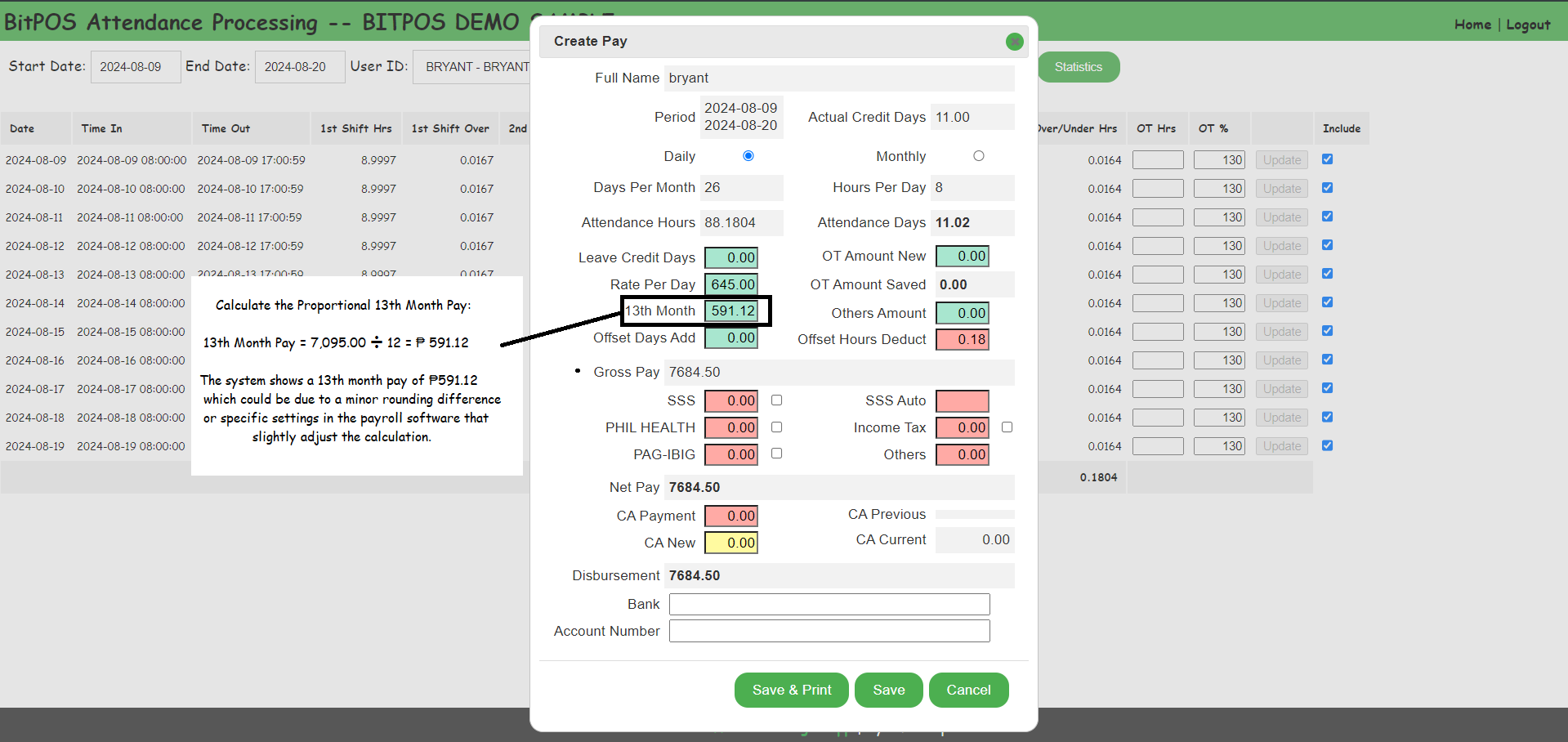

- E.) Offset Hours Deduct: the hours adjusted from an employee's total worked hours due to either underworked or overworked time.

- Example: The total attendance hours are 88.1804. The excess of 0.1804 hours should be recorded as Offset Hours Deduct, as the cutoff period is 11 days, with 8 hours per day, totaling 88 hours.

- 88.1804 - 88.00 = 0.1804 (Offset Hours Deduct) round to 0.18

- F.) 13th Month: 13th Month is a year-end bonus equivalent to one-twelfth (1/12) of an employee's total basic salary for the year.

NOTE: The 13th month pay can be distributed either at the end of the year or with each payday, depending on the company's policy.

The computation shown in this payroll reflects a 13th month pay that is distributed with each payday.

- 13th Month Computation:

- Calculate the Total Basic Salary for the Period:

- The daily rate is ₱ 645.00.

- The actual credited days worked in the period is 11.00 days.

- Total Salary for the Period = 645.00 × 11.00 = ₱ 7,095.00

- Calculate the Proportional 13th Month Pay:

- Since the 13th month pay is equivalent to one month's pay divided by 12, the proportional 13th month pay for the period is:

- 13th Month Pay = 7,095.00 ➗ 12 = ₱ 591.12

- The 13th month pay displayed in the system (₱591.12 ) the system shows a 13th month pay of ₱591.11, which could be due to a minor rounding difference or specific settings in the payroll software that slightly adjust the calculation.

|

- G.) Offset Days Add: refers to extra days added to an employee's attendance record, typically to compensate for additional work or correct errors. In your data, it shows "0.00," meaning no extra days were added for this payroll period.

- H.) Gross Pay: the total amount of money an employee earns before any deductions (such as taxes, SSS, PhilHealth, or PAG-IBIG contributions) are made. It includes the base salary, overtime pay, allowances, and any bonuses like the 13th month pay. In the data provided, the Gross Pay is the sum of all earnings calculated before applying any deductions.

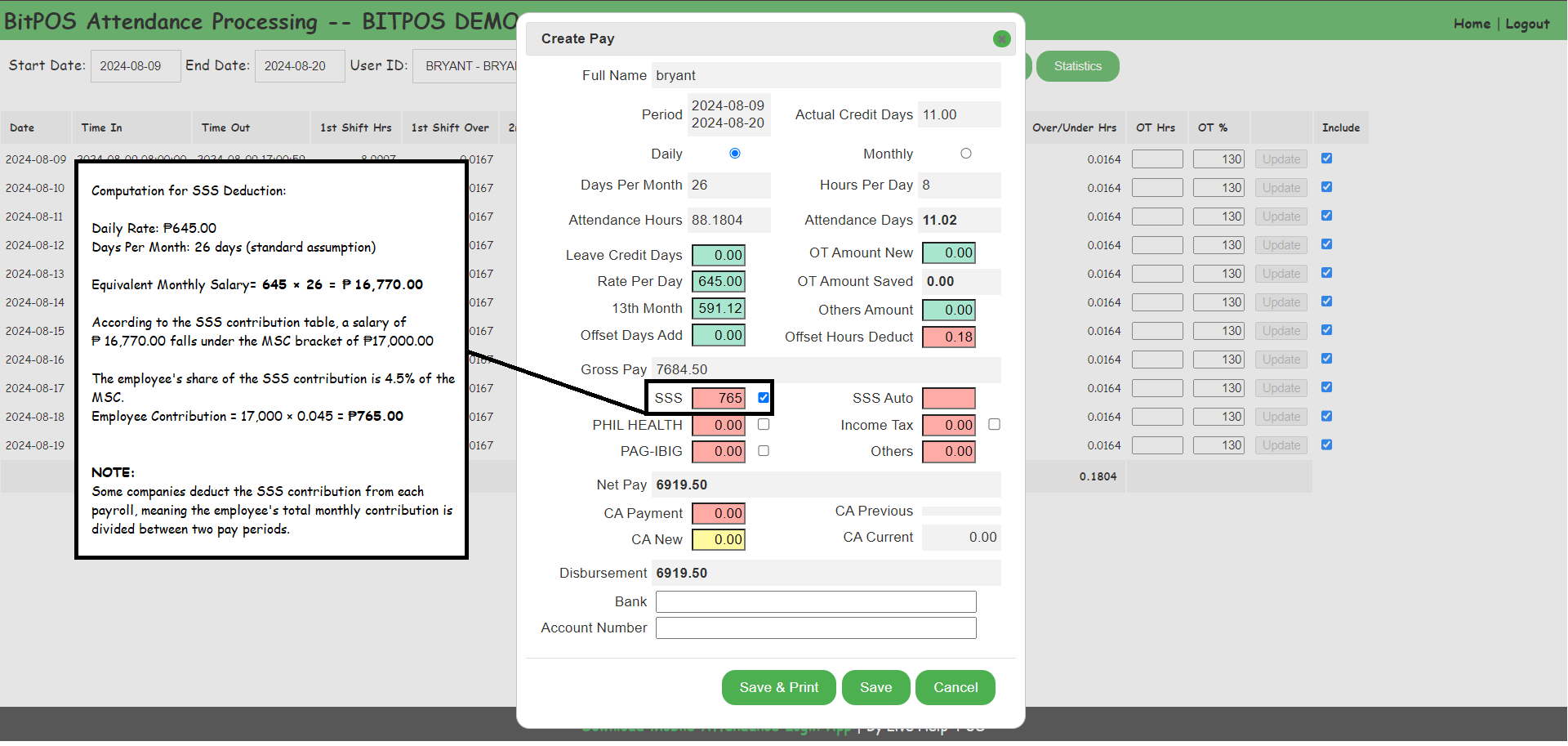

Employee's Deduction

- I.) SSS: is the amount taken from an employee's salary to contribute to the Social Security System (SSS) for benefits like retirement, disability, and sickness.

- Computation for SSS Deduction:

- Daily Rate: ₱645.00

- Days Per Month: 26 days (standard assumption)

- Equivalent Monthly Salary=645×26=₱16,770.00

- According to the SSS contribution table, a salary of ₱16,770.00 falls under the MSC bracket of ₱17,000.00

- The employee's share of the SSS contribution is 4.5% of the MSC.

- Employee Contribution=17,000×0.045=₱765.00

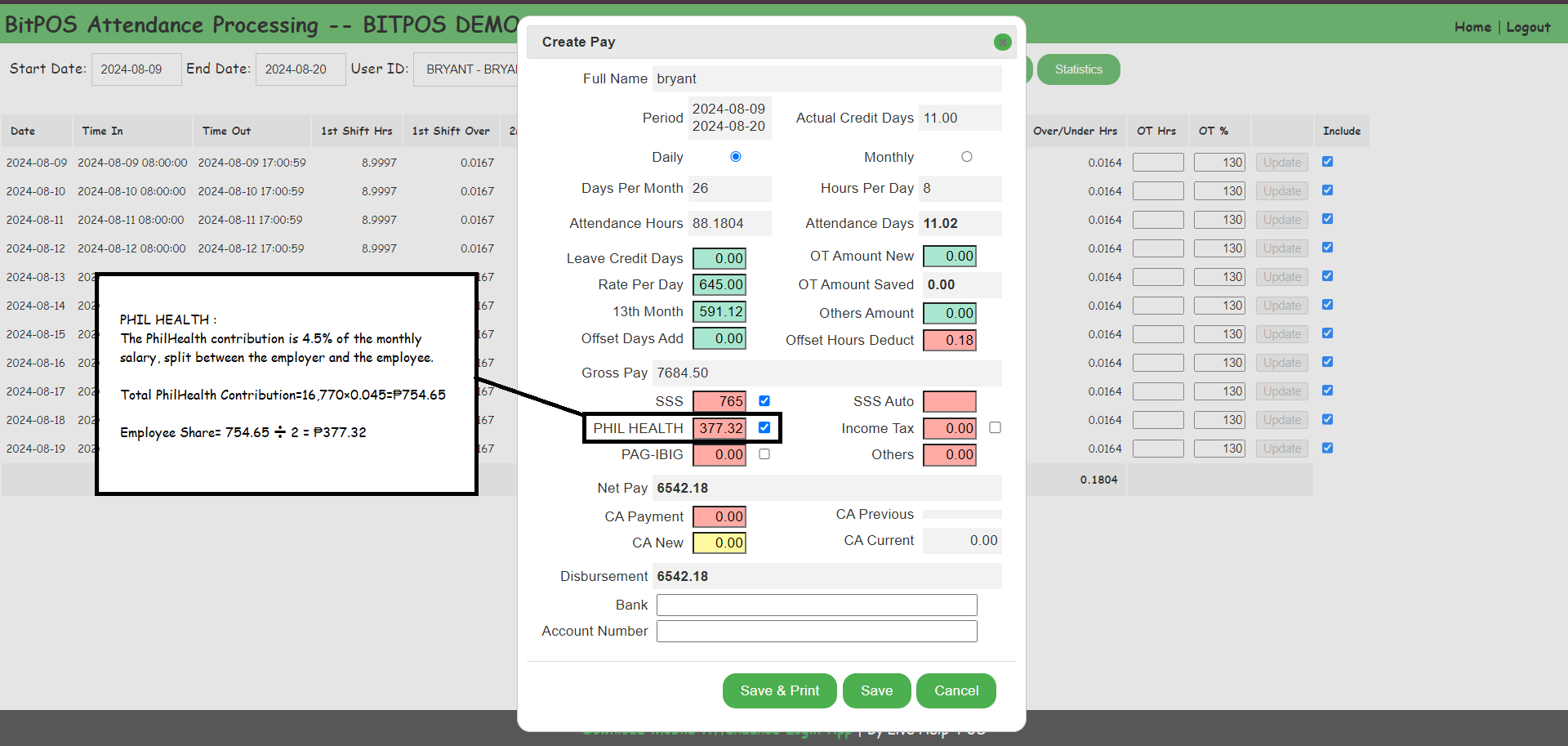

- J.) PhilHealth : is the portion of an employee's salary that goes towards health insurance coverage under PhilHealth. The contribution is a percentage of the salary and is shared by both the employee and employer.

- The PhilHealth contribution is 4.5% of the monthly salary, split between the employer and the employee.

- Total PhilHealth Contribution=16,770×0.045=₱754.65

- Employee Share= 754.65 ➗ 2 = ₱377.32

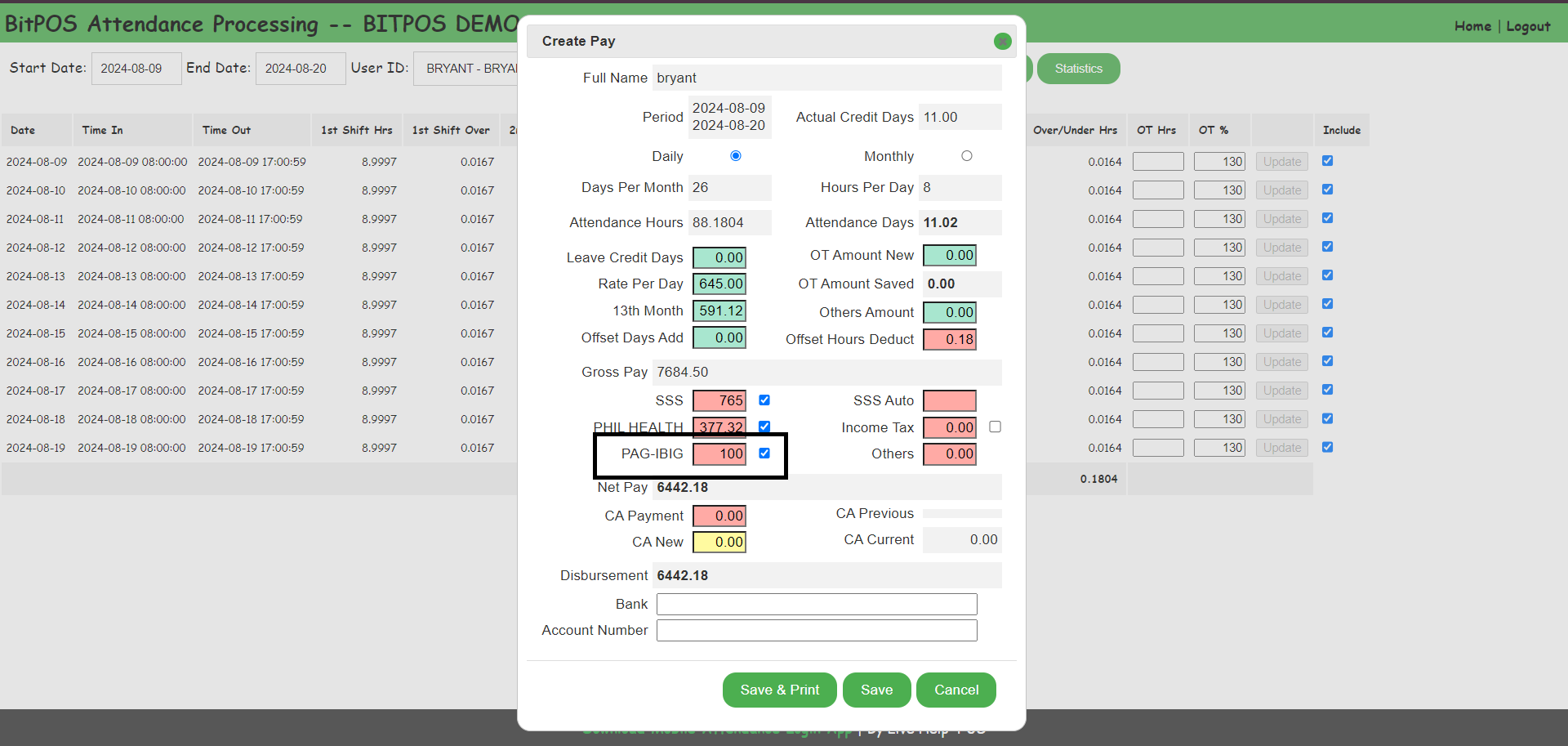

- K.) PAG IBIG: the part of an employee's salary that goes to the Pag-IBIG Fund for housing and savings benefits. Both the employee and employer contribute a fixed amount.

- The Pag-IBIG contribution is fixed at 2% of the monthly salary for both the employer and the employee, but it is capped at ₱100 each.

- Since the monthly salary is ₱16,770.00, which is above the cap, the contribution is ₱100.

- Employee Share = ₱100.00

- SSS Auto : is a set deduction for SSS Contribution

- Income Tax : If Eligible

- Others: These deductions are itemized separately and are applied as needed based on the company's policies or specific circumstances affecting the employee's pay.

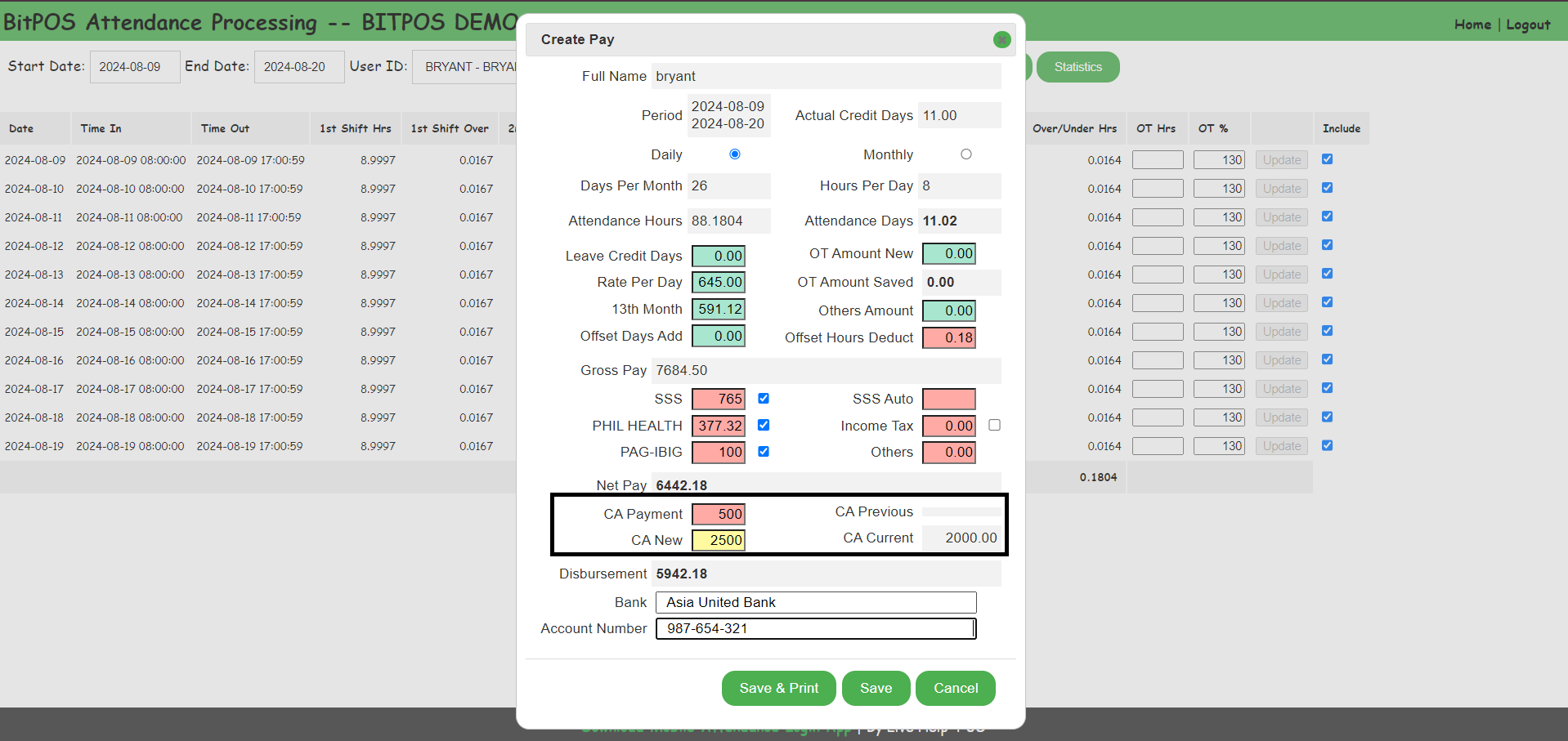

- CA Payment: the amount deducted from an employee's salary during the current payroll period to repay an existing cash advance (CA).

- CA New: New Cash Advance

- CA Previous: Automated recording of the system from Past UNPAID Cash Advance

- CA Current: Current Cash Advance of the Employee

- Disbursement: refers to the net amount of salary that an employee receives for a specific period, after all contributions (like SSS, PhilHealth, and Pag-IBIG) and other deductions (such as loan repayments, taxes, or penalties) have been subtracted from the gross pay.

- Bank :Optional

- Account Number: Optional

- Click Save