Aged Customer Analysis'

What is Aged Customer Analysis?

The Aged Customer Analysis Report is a financial document that categorizes outstanding customer balances based on the length of time the invoices have been outstanding. It typically organizes balances into predefined time periods, such as 30 days, 60 days, 90 days, and beyond. This report provides insights into the aging of customer receivables, allowing businesses to assess the effectiveness of their credit and collections policies. It helps identify overdue accounts and prioritize collection efforts accordingly. By analyzing this report, businesses can better manage cash flow, reduce bad debt, and improve overall financial performance.

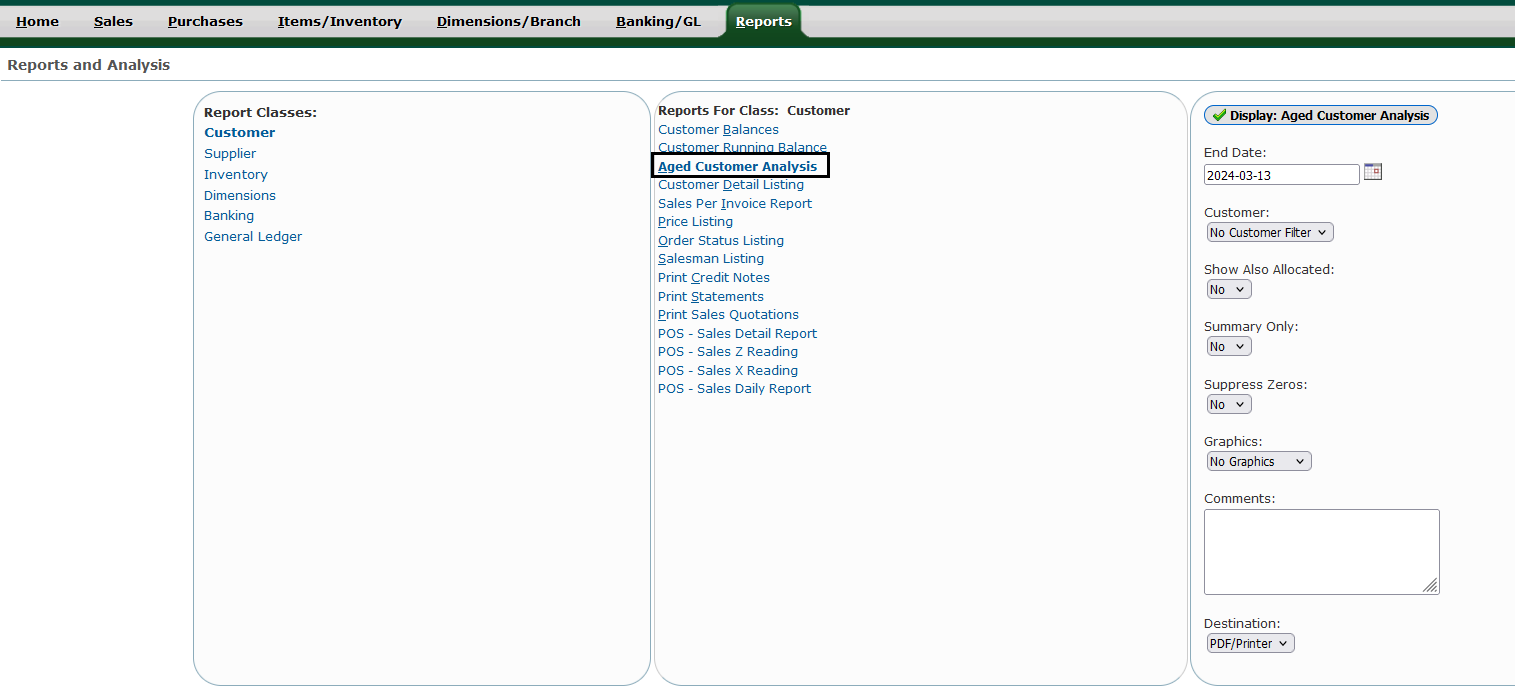

- Step 1: Go to back office

- Select Reports Module

- Select Aged Customer Analysis

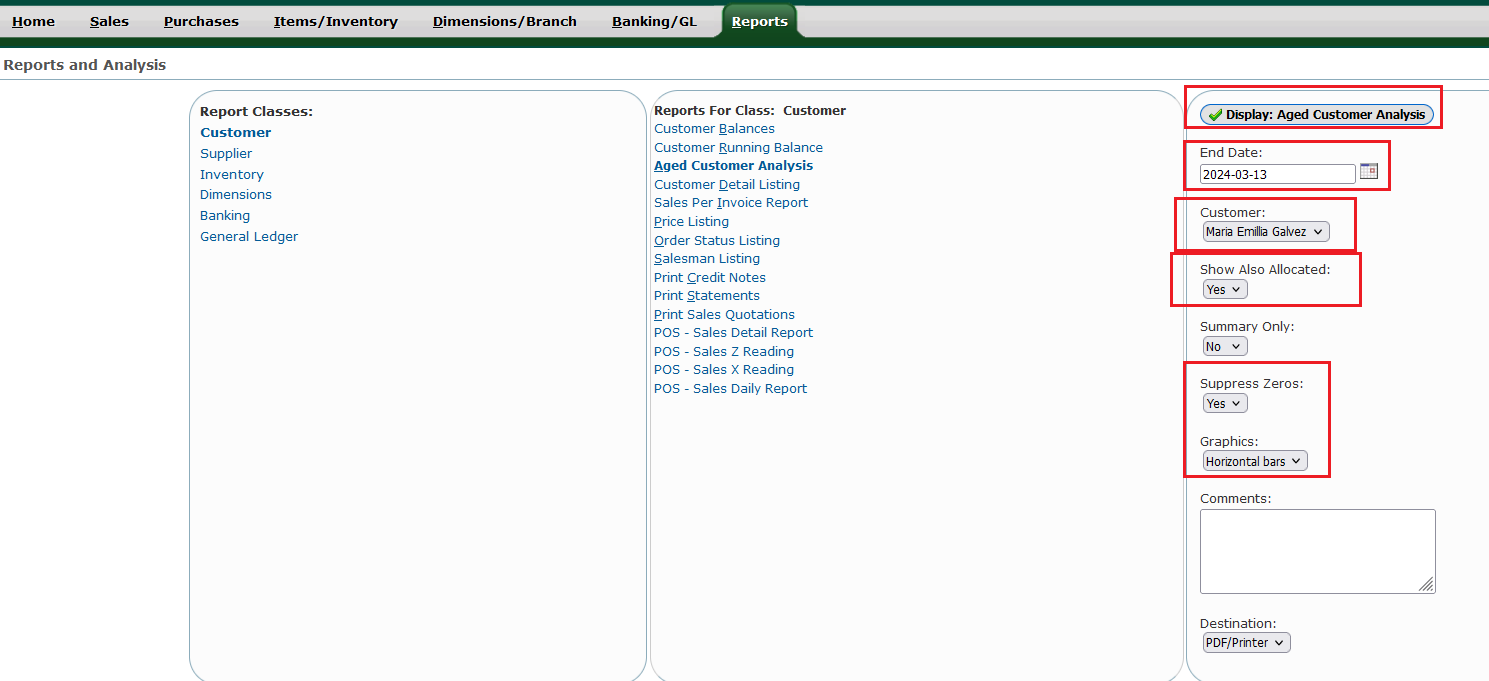

- Step 2: You may filter the dates (start - end)

- Filter the customer Name

- Show allocated (Payment allocated for Customer)

- Summary Only

- Supress Zero (no Zero Quantity)

- Graphics

- Destination (PDF and Excel)

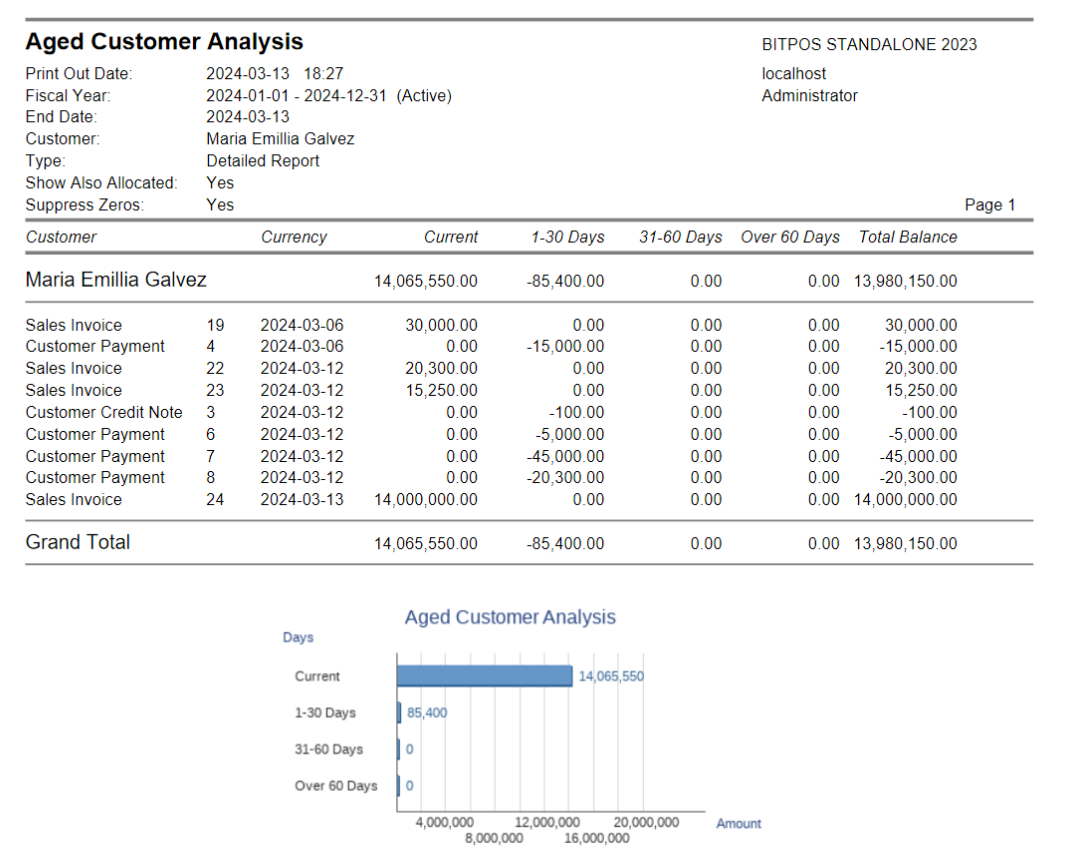

- Step 3: Check report content